Business Accounts

We Offer A Wide Range of Accounts To Meet Your Needs

Our representatives can help you determine which products will best suit your financial needs.

Business Savings

Features: ($100 minimum to open)

Put your extra capital to work full-time. Let us help play a role in your cash flow planning.

- Multiple options to avoid monthly statement fee

- Earns a competitive interest rate[1]

- Free ATM Card[3]

- Free Telephone Banking

- Free Online Banking

- Free Mobile Banking

Business Checking

Features: ($100 minimum to open)

Security State Bank offers an easy to maintain checking account that creates opportunities to reduce or eliminate fees. Help eliminate paper, speed up your cash cycle, and reduce the time away form what you do best.

- Interest bearing and non interest bearing Checking Accounts available[1]

- Unlimited check writing

- Free ATM Card/Debit Cards[2]

- Free Telephone Banking

- Free Online Banking

- Free Mobile Banking

- Additional Services Available: Cash Management, Merchant Services

- Low monthly service fee (ask how this fee can be waved)

Business Money Market

Features: ($100 minimum to open)

Maximize your earnings while enjoying a higher interest rate and retaining easy access to your funds.

- Small service fee may apply

- Earns a competitive interest rate[1]

- Limited w/d transactions

- Free ATM Card[3]

- Free Telephone Banking

- Free Online Banking

- Free Mobile Banking

Business Benefits:

Business Online Banking

We have the tools to help manage your business more efficiently. Designed for businesses of all sizes, Business Online Banking & Cash Management offers valuable services that save time and money. Make payments, transfer funds, and manage cash flow with convenience and ease. Let us exceed your expectations.

Features:

- Real-time Account Balances

- Direct Deposit of Payroll

- Transfer Funds between accounts in real time

- State and Federal Tax Payments

- Bill Pay Services

- Soft Tokens

- All in a fully safe and secure environment

- Access to Cash Management Tools including: Business Bill Pay, ACH Manger and much more

Credit Card Processing

Features:

Upgrade your debit card and credit card processing to personal payment processing from Security State Bank and our partner BASYS Processing. Accept payments every way your customers want to pay that is safe, convenient, and affordable for your business.

Our valued customers will enjoy the following benefits:

- A dedicated relationship manager for all customer service inquiries

- Comprehensive PCI Compliance support

- Online reporting capabilities

- Acceptance of all major card brands

- Equipment for all situations: in-person, over the phone, online, contactless, and mobile

- Competitive rates

To see our current rates, Click Here.

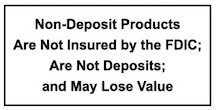

To learn more about FDIC Insurance, Click Here.

[1]Rates subject to change/Based on average daily balances

[2]Applicable fees may apply

[3] Non-Security State Bank ATM fees may apply