Security State Bank Remains Strong

As your community bank, Security State Bank listens to its customer. Right now, we’re hearing that the recent closure of Silicon Valley Bank and Signature Bank are causing concerns about the stability of the banking industry. We want to reassure you that your money is safe with us.

It’s important to remember that Wyoming’s community banks, like SSB, operate under an entirely different business model than mega-banks in California and New York City. Community banks are rooted in Wyoming’s neighborhoods and focused on meeting the needs of local folks. Because our strength comes from our communities, we are more diversified and make decisions based on safeguarding what’s important to you.

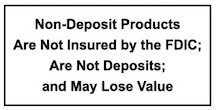

We are proud to serve our customers and communities, and we are committed to ensuring the security of your deposits. No depositor below the $250,000 FDIC insurance limit has ever lost a dime in a community bank. We remain well-capitalized and well-positioned to continue serving our customers and community for generations to come.

If you have questions about your coverage, or would like to learn more about FDIC insurance and how it works, we encourage you to access the following resources or give us a call directly. Our experienced team is ready to assist you at all times with any of your questions or concerns.

In short, Wyoming community banking remains strong, well-capitalized, and resilient. Thank you for choosing Security State Bank as your community bank, and we look forward to continuing to serve you.